Fabrick Advice

Fabrick Advice is the complementary service to Fabrick Guaranteed payments, which enables an operation of "transaction risk analysis" to take advantage of the exemptions from PSD2 (Powered by Riskified).

The risk analysis with Fabrick Advice includes the following steps: firstly, pre-authorization risk analysis is carried out, it is aimed at assessing the possibility of the exemption of the transaction from the authentication process. Secondly, for exempt transactions, more accurate and aimed at guaranteeing the transaction against any chargebacks, a second risk analysis is performed. The exemptions are applicable to transactions for amounts within the thresholds of €100, €250 or €300, the amount is based on the fraud rates of the acquirer in question.

Fabrick Advice, while inserted in the entire transactional flow, can determine the following scenarios:

Transaction not eligible for the TRA application

The transaction is processed normally through a 3DS flow.Transaction eligible for the TRA application

The transaction is analysed by Fabrick Advice, which will provide one of the following outcomes:Fraud

Transaction with a high-risk fraud - the transaction process is interrupted with a KO alert.3DS2

The transaction represents a moderate risk of fraud, so it is advisable to proceed with authentication.Exemption

The transaction represents a low risk of fraud, therefore, it is possible to proceed with an exemption request:Exemption accepted

The transaction is processed in exemption and, if the outcome is positive, Fabrick Guaranteed payments is applied in order to guarantee the transaction in the event of any fraudSoft decline

In this case the issuer has decided to reject the exemption request, therefore, the transaction is subject to the security protocols

Activation of Fabrick Advice can be requested from your Account Manager, and Fabrick Guaranteed payments must also be active.

Implementation

For the implementation, the steps described for Fabrick Guaranteed payments must be followed.

Compared to that service, the substantial differences are that there will no longer be only an approved or declined result, but it may be required to authenticate the transaction (soft error 8006) or, in rare cases, the transaction may not be authorised if there is a high risk of fraud.

Testing Fabrick Advice in sandbox

For transactions of the amount less than 250 EUR, by inserting the e-mails in the OrderDetails > CustomerDetail > PrimaryEmail field and using the indicated cards, it is possible to test the main scenarios that might arise in production in sandbox.

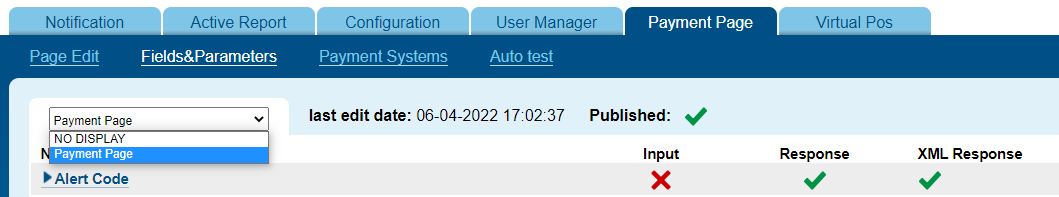

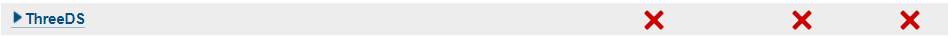

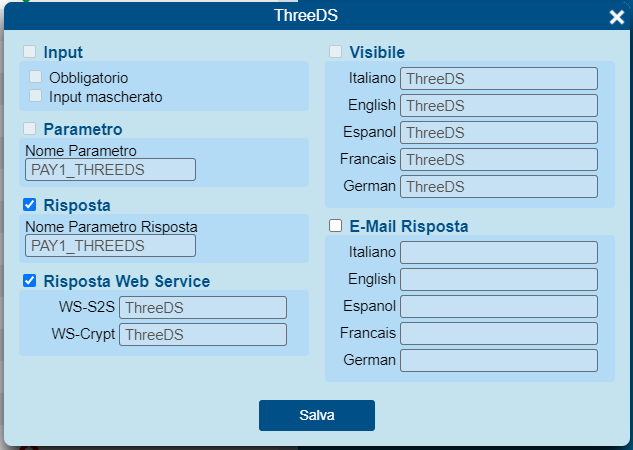

By activating the ThreeDS field on Merchant Back Office of Fabrick Payment Orchestra (NO DISPLAY> S2S; Payment page> Others), it becomes possible to check whether a transaction has been authenticated or not. An authenticated transaction will have an authenticationLevel 2C, 2F, 1F, 1H and authenticationStatus Y or A, different values of authenticationStatus, including null, which indicates a failed authentication.

The only exception is 1H which, if it is null, would indicate that the card has been verified, but since the card is not 3DS1 enabled, and the merchant is 3DS enabled, the liability is the responsibility of the issuer.

Payment Page> Fields & parameters

ThreeDS

Activation

Before proceeding with activation in production, it will be necessary to share some tests performed on standard scenarios with Fabrick, just like for the Fabrick Guaranteed payments service.

Here are some examples:

Transaction authorised and approved by the service, and then captured.

Transaction authorised and approved by the service, and then canceled.

Transaction authorised and declined by the service, and then canceled.

Transaction authenticated, authorised and captured.

Transaction declined by the service

We recommend testing and unveiling the more complete cases. For example, for a merchant that supplies physical and digital goods: making a transaction for physical and digital items, indicating a shipping address different from the billing address, verifying that the sum of the items, shipping costs, subtracting any discounts, comes back with a result as requested in the authorisation.

Here https://api.axerve.com/#example-sofort you can find the description of the fields that need to be filled with the indication Required / Recommended / Optional and the various constraints (dimensions, accepted values). In the Fabrick Guaranteed payments documentation there are examples to use based on the chosen integration and type of business.